Insider Trading and Market Abuse: Principle of Abstention

The current regulatory framework, primarily governed by the European Market Abuse Regulation (MAR) and the French Monetary and Financial Code (CMF), establishes a strict regime to prevent the abusive use of inside information, notably through the duty of abstention and the implementation of insider lists.

I – Définition and Sanctions

The fundamental principle is that any person in possession of inside information must refrain from conducting transactionsin the relevant financial instruments as long as the information has not been made public.

Definition of Inside Information

Under Article 7 of the MAR Regulation, inside information is defined as information that is:

*Precise;

*Non-public;

*Directly or indirectly related to one or more issuers or to one or more financial instruments;

*Likely to have a significant effect on the price of the relevant financial instruments or related instruments if it were made public.

Criminal Sanctions (Insider Trading)

Article L. 465-1 of the French Monetary and Financial Code criminalizes the act, for any person in possession of inside information (primary or secondary insider), of knowingly carrying out or permitting transactions before the information is made public.

Penalties: Up to five years’ imprisonment and €100 million in fines, which may be increased up to ten times the profit obtained, without being less than the profit itself.

Administrative Sanctions (Insider Breach)

The Autorité des marchés financiers (AMF) may impose administrative sanctions for the illicit use or disclosure of inside information, under MAR and the CMF.

These sanctions may be cumulative with criminal penalties, subject to the non bis in idem principle (prohibition of double punishment for the same conduct), and are guided by jurisprudence.

II – End of the Duty of Abstention

The duty of abstention ceases once the inside information has been effectively, fully, and adequately made public, in accordance with Article 17 MAR.

Issuers must ensure that information is simultaneously disseminated to the entire market to guarantee equal treatment of investors.

III – Obligation to Maintain Insider Lists

Issuers are legally required to establish and maintain insider lists, in accordance with Article 18 MAR and Article L. 451-4 CMF.

Purpose of Insider Lists

Insider lists are a key tool for both issuers and the AMF:

– They allow issuers to control the flow of information and ensure that relevant persons are aware of their obligations.

– They facilitate AMF investigations in cases of suspected market abuse.

Categories and Format

The obligation applies to the issuer itself or to any person acting on its behalf (e.g., external advisors, rating agencies).

- Transaction-Based Insider List (Required):

– Standard and most common format; a specific list must be created for each piece of inside information.

– Must include all persons (executives, employees, consultants, lawyers, etc.) with access from the moment the information is deemed privileged.

- Permanent Insider List (Optional):

Issuers may also create a separate list for persons who, due to their role (e.g., CEO, Secretary-General, certain board members), have continuous access to all insider information.

Content of the List

According to Article 18 MAR, the list must include:

*Name, surname, birth name, date of birth, professional and personal address;

*Reason for inclusion (function/role);

*Date and time of access to the inside information;

*Professional and personal contact details (phone, email).

Lists must be retained for at least five years from creation or last update.

Management of Inside Information (Information Embargo)

Issuers must implement organizational and administrative measures (commonly called “information barriers” or Chinese walls) to ensure the confidentiality of inside information.

Black-Out Periods

Issuers must define periods during which certain persons (notably executives and closely related individuals) must refrain from trading the issuer’s securities.

– Regulatory Obligation (Article 19 MAR): A minimum 30-day prohibition applies before the publication of an interim or year-end financial report.

– Internal Measures: Issuers often impose longer or additional black-out periods, related to specific inside information or upcoming major events.

Confidentiality Measures

Issuers must ensure the confidentiality of inside information, including when publication is delayed (Article 17 MAR). Measures may include:

– Strict internal procedures for document and server access;

– Use of passwords and traceability systems;

– Regular training and awareness programs for executives and employees regarding market abuse risks and obligations.

Disclaimer

This note was prepared by the law firm JACQUES ELIE LEVY AVOCAT for general informational purposes only. It does not constitute legal advice or a legal consultation within the meaning of French Law No. 71-1130 of 31 December 1971. The information contained herein reflects the state of the law at the date of publication and may be subject to change. It cannot replace a case-by-case analysis of each individual situation. The firm shall not be held liable for any decisions taken solely on the basis of this note. JACQUES ELIE LEVY AVOCAT remains available to the reader to review, if necessary, the specific legal issue at hand and provide appropriate guidance or assistance.

Copyright

© 2025 JACQUES ELIE LEVY AVOCAT. All rights reserved.Any reproduction or representation, in whole or in part, of this document is strictly prohibited without prior written consent.

Notes juridiques

Insider Trading

Insider TradingI - PRINCIPLEIt is prohibited for any person in possession of inside information to use such information to buy or sell, for their own account or for the account of others, directly or indirectly, financial instruments to which that information relates....

The Challenges and Disappointments of Joint Ventures with China

Critical Analysis: The Challenges and Disappointments of Joint Ventures with ChinaJoint ventures (JVs) in China have often been promoted as a strategic path for Western companies to access the vast Chinese market, but in practice, many of these ventures have failed to...

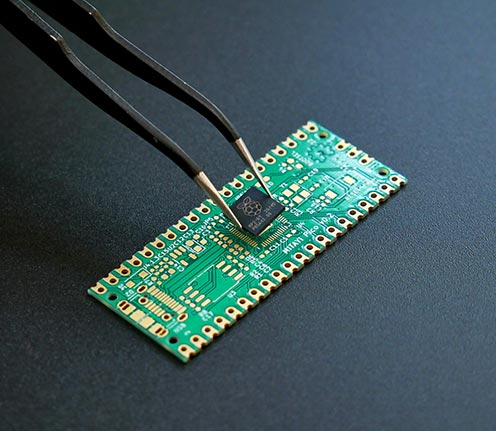

Legal Specificities in the Industrial and Semiconductor Sectors

Legal Specificities in the Industrial and Semiconductor SectorsThe industrial sector, and especially the semiconductor industry, operates within a highly complex and fast-evolving legal environment shaped by global supply chains, advanced technology, and regulatory...