Legal Specificities in the Industrial and Semiconductor Sectors

The industrial sector, and especially the semiconductor industry, operates within a highly complex and fast-evolving legal environment shaped by global supply chains, advanced technology, and regulatory scrutiny. Legal counsel in this context must go far beyond textbook advice, offering tailored, strategic guidance that accounts for technical complexity, commercial interdependence, and geopolitical risk.

Global Supply Chain Complexity

Semiconductor production involves a tightly integrated and international supply chain—spanning raw material sourcing, equipment procurement, manufacturing, assembly, and distribution. Legal oversight must address cross-border contract structures, performance risk, regulatory compliance, and dispute resolution in multiple jurisdictions.

Export Controls and Compliance

Because semiconductors are often classified as dual-use technologies, they are subject to strict export control regulations (e.g., U.S. EAR, EU dual-use regime). Businesses must navigate a dynamic landscape of trade restrictions, sanctions, and licensing requirements that impact both commercial decisions and compliance obligations.

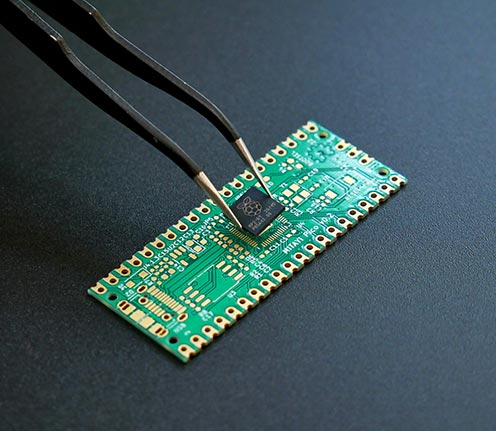

Intellectual Property Strategy

IP is the lifeblood of the semiconductor industry. Legal protection of inventions and notably proprietary designs, manufacturing processes, and software is vital, especially in collaborative R&D environments. This calls for precise IP structuring, licensing agreements, and strong enforcement capabilities, both domestically and internationally.

R&D and Consortium Agreements

Innovation in semiconductors often occurs through joint ventures, public-private partnerships, and international R&D consortiums. These relationships require legally robust frameworks governing IP ownership, confidentiality, cost-sharing, and project governance, with a view to protecting future commercial viability.

Regulatory and Environmental Challenges

Semiconductor manufacturing involves highly specialized facilities with significant environmental and safety considerations. Legal compliance must address emissions control, energy usage, labor regulations, and sustainability requirements—each of which can vary significantly by region and facility type.

M&A and Investment Sensitivities

Given their strategic importance, semiconductor companies are often subject to foreign investment review, antitrust scrutiny, and national security assessments. Legal advisors must anticipate and navigate these controls during cross-border mergers, acquisitions, or capital raises.

Conclusion

The legal framework governing industrial and semiconductor operations is exceptionally nuanced and high-stakes. Providing effective counsel requires not only legal expertise, but also a deep understanding of the sector’s technical, operational, and commercial imperatives. This is the value I bring: combining international legal knowledge with real-world experience in one of the world’s most strategically vital industry.

Disclaimer

This note was prepared by the law firm JACQUES ELIE LEVY AVOCAT for general informational purposes only. It does not constitute legal advice or a legal consultation within the meaning of French Law No. 71-1130 of 31 December 1971. The information contained herein reflects the state of the law at the date of publication and may be subject to change. It cannot replace a case-by-case analysis of each individual situation. The firm shall not be held liable for any decisions taken solely on the basis of this note. JACQUES ELIE LEVY AVOCAT remains available to the reader to review, if necessary, the specific legal issue at hand and provide appropriate guidance or assistance.

Copyright

© 2025 JACQUES ELIE LEVY AVOCAT. All rights reserved.Any reproduction or representation, in whole or in part, of this document is strictly prohibited without prior written consent.

Legal Briefs

Insider Trading and Market Abuse: Principle of Abstention

Insider Trading and Market Abuse: Principle of AbstentionThe current regulatory framework, primarily governed by the European Market Abuse Regulation (MAR) and the French Monetary and Financial Code (CMF), establishes a strict regime to prevent the abusive use of...

Insider Trading

Insider TradingI - PRINCIPLEIt is prohibited for any person in possession of inside information to use such information to buy or sell, for their own account or for the account of others, directly or indirectly, financial instruments to which that information relates....

The Challenges and Disappointments of Joint Ventures with China

Critical Analysis: The Challenges and Disappointments of Joint Ventures with ChinaJoint ventures (JVs) in China have often been promoted as a strategic path for Western companies to access the vast Chinese market, but in practice, many of these ventures have failed to...