Critical Analysis: The Challenges and Disappointments of Joint Ventures with China

Joint ventures (JVs) in China have often been promoted as a strategic path for Western companies to access the vast Chinese market, but in practice, many of these ventures have failed to meet expectations. While they may offer initial promise, a significant number end with disappointing outcomes for the Western partner—and disproportionate benefits for the Chinese side.

Uneven Value Capture: Technology Transfer without Strategic Return

Example: Danone – Wahaha Group (Food & Beverage)

Danone entered a JV with Chinese beverage giant Wahaha in the 1990s, aiming to tap into China’s consumer market. Over time, Wahaha created parallel operations under its own brand, allegedly using the JV’s assets and know-how. Legal disputes ensued in both Chinese and international courts. Ultimately, Danone exited the JV in 2009 after failing to enforce its rights, suffering reputational and financial damage.

Example: General Motors – SAIC (Automotive Technology)

GM has had a long-standing JV with SAIC, which initially allowed GM to dominate the Chinese automotive market. However, in recent years, SAIC has leveraged its JV experience to grow independent brands and export globally—sometimes in direct competition with GM. GM now faces eroding market share, squeezed margins, and reduced strategic control in what was once its most promising market.

Governance and Control: Lack of Real Influence

Example: Ericsson – Panda Electronics (Telecommunications)

Ericsson entered a JV with Panda Electronics in the early 1990s. Despite bringing in critical telecom technology, Ericsson struggled with governance control and market strategy execution. The venture suffered persistent losses and misalignment, leading Ericsson to exit the Chinese JV structure entirely by the early 2000s.

Example: GSK – Chinese Pharma Operations

GlaxoSmithKline (GSK) experienced severe issues in its Chinese operations, including within JV-like partnerships, when it was implicated in a major bribery scandal in 2013. Although not a JV failure in the conventional sense, the lack of effective oversight in its localized structure led to reputational, legal, and financial damage—highlighting the governance risks of operating through Chinese intermediaries or shared structures.

IP Leakage and Replication

Example: RCA (now part of GE/Thomson) – Various Chinese JVs

In the 1980s and 1990s, RCA and its successors formed multiple JVs to manufacture consumer electronics and display technologies in China. Much of the transferred technology was rapidly absorbed and redeployed by Chinese partners, leading to the development of local competitors. RCA eventually lost market relevance in the region, and key technologies became commoditized.

Example: Alstom – Chinese Rail Sector (High-Speed Trains)

French rail company Alstom entered into multiple partnerships and licensing arrangements with Chinese entities, transferring high-speed train technology. Over time, Chinese firms such as CRRC not only absorbed the technology but developed and exported their own competing systems globally, significantly reducing Alstom’s long-term competitive advantage.

Regulatory Barriers and Exit Restrictions

Example: Yahoo – Alibaba (Technology)

Yahoo’s early investment in Alibaba was immensely profitable, but its JV with Alibaba over Chinese operations (Yahoo China) became fraught with governance disputes and regulatory roadblocks. Yahoo lost operational control, and after protracted conflict, eventually divested under pressure—with limited influence over the terms.

Example: Google – China Market Exit

Though not structured as a JV, Google’s attempt to comply with Chinese censorship and partner with local services failed. Facing both government pressure and domestic replication (notably Baidu and Tencent’s dominance), Google withdrew from the Chinese search market in 2010—illustrating the broader difficulty of securing fair and sustainable operations in strategic tech sectors.

Conclusion: Learn from the Patterns

These and many other examples reveal consistent patterns in China-based joint ventures:

- Technology transfer without reciprocal access or long-term control

- Governance imbalances that leave Western partners sidelined

- Regulatory systems that are unpredictable or strategically biased

- Difficult or blocked exits, even after years of investment

For companies in industrial, tech, or IP-driven sectors, it is vital to rigorously evaluate whether a JV is the right structure—or whether other models (e.g., WFOEs, licensing, or distribution alliances) offer a more defensible and strategically sound route.

Disclaimer

This note was prepared by the law firm JACQUES ELIE LEVY AVOCAT for general informational purposes only. It does not constitute legal advice or a legal consultation within the meaning of French Law No. 71-1130 of 31 December 1971. The information contained herein reflects the state of the law at the date of publication and may be subject to change. It cannot replace a case-by-case analysis of each individual situation. The firm shall not be held liable for any decisions taken solely on the basis of this note. JACQUES ELIE LEVY AVOCAT remains available to the reader to review, if necessary, the specific legal issue at hand and provide appropriate guidance or assistance.

Copyright

© 2025 JACQUES ELIE LEVY AVOCAT. All rights reserved.Any reproduction or representation, in whole or in part, of this document is strictly prohibited without prior written consent.

Legal Briefs

Insider Trading and Market Abuse: Principle of Abstention

Insider Trading and Market Abuse: Principle of AbstentionThe current regulatory framework, primarily governed by the European Market Abuse Regulation (MAR) and the French Monetary and Financial Code (CMF), establishes a strict regime to prevent the abusive use of...

Insider Trading

Insider TradingI - PRINCIPLEIt is prohibited for any person in possession of inside information to use such information to buy or sell, for their own account or for the account of others, directly or indirectly, financial instruments to which that information relates....

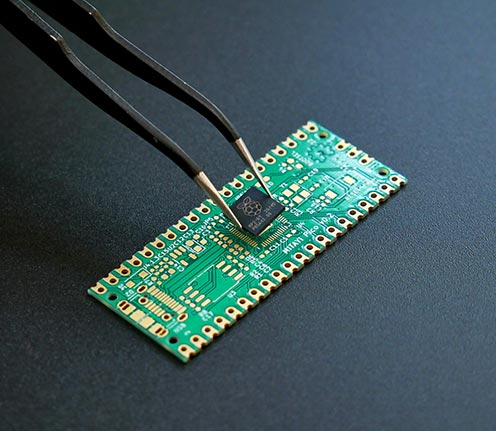

Legal Specificities in the Industrial and Semiconductor Sectors

Legal Specificities in the Industrial and Semiconductor SectorsThe industrial sector, and especially the semiconductor industry, operates within a highly complex and fast-evolving legal environment shaped by global supply chains, advanced technology, and regulatory...